Abhishek Bose·Saturday, March 14 2020·Improve this Guide

Abhishek Bose·Saturday, March 14 2020·Improve this Guide

💵 How to get paid in dollars

FAQ for contractor working for a US company

⚠️ All of this info comes with a disclaimer that we are not experts. Definitely double check with your CA.

Context

You are working as a contractual software developer from India with a company based in the US.

Do I need to register as a sole proprietor firm

It doesn’t matter if you are a freelancer or a registered Proprietor - you will need to pay the same tax (and GST if liable).

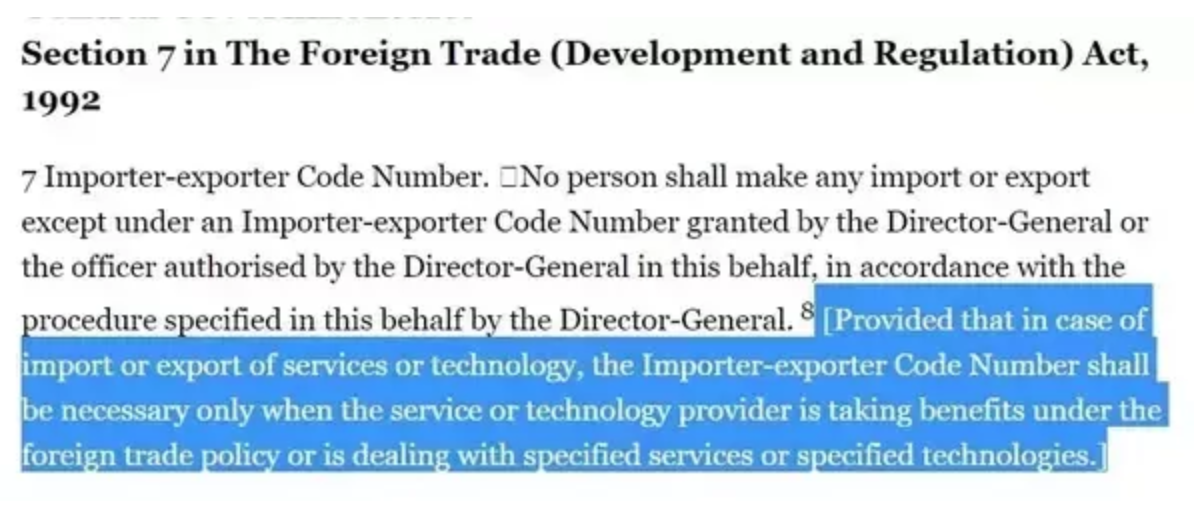

If I am giving service outside India do I need Import Export code(IEC)

Based on this quora answer, it seems like you don’t need an IEC.

It is not necessary for export of services for freelancers (as these would be general services).

Please have a look at the highlighted text of Sec 7 below:

Should I register for GST

You don’t need a GST until you hit a INR 20 lakh receipt threshold.

If you are earning more than that, get money post GST registration and LUT filing only.

For software exports, you should be able to take advantage of zero rated GST (0% GST) by submitting a letter of undertaking (LUT) to the authorities. - https://taxguru.in/goods-and-service-tax/rating-gst.html

Do I need to open a current account if I am receiving foreign remittance?

It would be great because a Current Account gets better conversion rates (ask for an EEFC account).

“To give you an idea, a few years ago, I would get the money to my personal (Savings) account, I would pay around Rs. 1.5 - Rs. 2 to the dollar in conversion charges. Now I am charged 50p more than the exchange rate” - @Saurabh

What is an EEFC?

Exchange Earners' Foreign Currency Account (EEFC) is an account maintained in foreign currency with an Authorised Dealer Category - I bank i.e. a bank authorized to deal in foreign exchange. It is a facility provided to the foreign exchange earners, including exporters, to credit 100 per cent of their foreign exchange earnings to the account, so that the account holders do not have to convert foreign exchange into Rupees and vice versa, thereby minimizing the transaction costs.

More info here -> https://m.rbi.org.in/Scripts/FAQView.aspx?Id=21

How to manage taxation? Does the company (which I will register) need to do its own taxation and on personal level I'd need to do my own taxation?

Yes, you will be a contractor and need to do your own taxes. They will make you fill a W8BEN form mostly.

- You can pay how much ever tax you need, but you also need to file returns. The max slab of course is 30% if you do not want to show any deductions. This would be the same as any salaried person except your ITR form would be that for a consultant / self employed person and not a salaried person. (There is also a surcharge of 10% for 50L income and 15% over 1Cr)

- You would need to pay advance tax 4 times a year

- If your clients are Indian, you will have to charge them GST and file that separately (if your income > INR 20L)

Unfortunately, this is not trivial — so you would definitely need a CA to do this for you 🤷

More details about Presumptive Taxation - https://getmoneyrich.com/presumptive-taxation-44ada/

How do I get paid?

The general consensus on this group has been:

- Bank wire transfers are best if your client agrees to it. You should set up an EEFC account. ICICI generally has good conversion rates.

- Transferwise is probably the other best option. But the client needs to have an account as well.

- The other thing people have tried and liked is Payoneer. That gives you a US / UK bank account - so your client can pay locally and money gets converted to your Indian bank account.